TechRadar Verdict

This is an easy to use trading platform which is great for novices, but there are limitations such as no short-selling to be aware of.

Pros

- +

Demo accounts available

- +

Easy to use interface

- +

Zero commission

- +

Ideal for beginners

Cons

- -

Inactivity fee

- -

Short-selling not allowed

Why you can trust TechRadar

Trading 212 is a London-based brokerage platform that aims to democratize trading by making it accessible to the masses. Founded in 2006, Trading 212 allows users to trade in a variety of assets including Forex and currencies, gold, commodities, crypto, and stocks, etc.

Trading 212 got the license to operate in the UK in 2013 and is approved by the FCA (Financial Conduct Authority of England and Wales). It has a freemium model offering the basic services without any charge hoping that the users opt for other paid services or transact on the CFD area of the platform.

As a user, you can use their web-based trading suite or download the application on your computer. There is even a mobile app available for both iOS and Android phones, in case you want to transact on the go.

What to expect

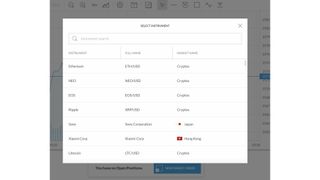

Trading 212 offers an easy DIY platform and allows over 1,800 instruments to trade, offering enough options to traders to decide where and how they want to invest their money. These instruments include major cryptocurrencies like Bitcoin, Ripple, LiteCoin, Ethereum, Monero, EOS, Dash, Neo and more. Traditional assets like stocks, commodities and indices can also be traded on the platform. The diverse list of assets and choices available to trade on the platform should be attractive to many users.

For first-timers, Trading 212 offers a demo account which lets you try out the platform and perform test transactions without registration. This demo account gives you a real-time experience of how the platform works on your computer and mobile applications. In case you decide to sign up, you do need to provide some official documents to verify your identity and address. These documents include:

- ID Proof: a scanned color copy of passport, driving license or national ID

- Address Proof: a utility bill or bank statement from the past three months carrying your address

These are simply standard requirements as part of anti-money laundering legislation.

There is a set of questions which you need to answer for the company to understand your experience level as a trader. Trading 212 might reject your application on sign up, if the firm feels that it might be too risky for you to transact on such a platform. The entire signup process may take a good 10-15 minutes, so keep that much time handy.

Trading 212 offers you three different types of account: Trading 212 Invest, Trading 212 CFD and Trading 212 ISA.

Trading 212 Invest is best suited for traders who like to invest and trade in equities. However, the platform does not allow short-selling of equities, so in case you’re only interested in this type of trading then Trading 212 is not the right platform for you. Trading 212 ISA is only for UK-based traders who want to benefit from tax-free trading up to a certain amount, while Trading 212 CFD is open for all international traders.

In terms of deposit and withdrawal options, Trading 212 offers multiple choices like bank transfers, credit and debit card payments, Skrill, PayPal, Dotpay, Giropay, and Direct eBanking. Note that it only accepts payments in currencies like GBP, EUR and USD.

The web platform is very easy to use and it offers an organized layout. On the extreme left, you have the instruments you follow by adding them to your watch-list. All your pending orders or previous purchases show right next to the watch-list. In case you want to modify your transaction after looking at the live trends, this can be done here as well.

The center part of the screen displays a detailed graph of any instrument that you want to follow. Useful tips and videos can be found on the bar on the right side. Various reports can be found grouped right under the login section.

Mobile app

The Trading 212 mobile application is also fairly easy to use and shows information in an easy to understand graphical format. Simple swipe gestures help you switch between different sections and instruments. You can set price alerts, access forum, reports, or training videos right from the menu. There is a demo account available for the mobile app too that allows you to transact in all the instruments.

Charges

Trading 212 is one of the few platforms that does not charge you for transactions and is transparent about the costs applicable with paid-for services. While withdrawing funds, there is a fee applicable on the wire transfers. Third-party transfer fees may also be levied, if applicable. The platform wants you to remain active and charges you for inactivity, if inactive for over 180 days consecutively.

Support

Customer support is one of the most important features of any trading platform. Support is available by calling in, email or even through the contact page on the site. The website also has a live chat option in case you want to chat with a representative.

Trading 212 offers support in a wide range of languages including English, German, Dutch, Spanish, French, Italian, Polish, Serbian, Norwegian, Swedish, Czech, Russian, Romanian, Turkish, Arabic, and Chinese.

Regulations and credibility

Trading 212 is a trusted broker registered in England and Wales, and is authorized by the Financial Conduct Authority (FCA). It is also registered in Bulgaria and is regulated by the local Financial Supervision Commission.

The company keeps the clients’ funds separate from the company funds and are protected under the Financial Services Compensation Scheme (FSCS) which offers a security of up to £85,000. In Bulgaria, 90% of deposits with a limit of €20,000 are secured by the Investors Compensation Fund or ICF Bulgaria.

Trading 212 allows users from across the globe to sign up, though regulations prohibit sign up from regions like American Samoa, Belgium, Democratic People's Republic of Korea (DPRK), Guam, Northern Cyprus, Northern Mariana Islands, Puerto Rico, Turkey, United States of America, and United States Virgin Islands.

Final verdict

Trading 212 is a very user-friendly trading platform, especially for beginners. The fact that you can try out the platform both on mobile and web before taking the plunge is a big advantage. Limitations like no short-selling may be a turn off for traders. However, the fact that Trading 212 offers over 1,800 assets and is very transparent about charges makes it one of the easiest recommendations for us.

- Best forex trading platform of 2020: trade and invest on your Android or iPhone

Jitendra has been working in the Internet Industry for the last 7 years now and has written about a wide range of topics including gadgets, smartphones, reviews, games, software, apps, deep tech, AI, and consumer electronics.

Can’t uninstall or update your Microsoft Store apps? Weird Windows 10 bug has just been fixed, thankfully

The end of Google Fit? Fitbit looks set to replace it on future Android phones – and bring its AI coach with it

Black Friday Dyson deals live: we're hand-picking all the best vacuum and haircare deals